Some Thoughts on 2014: Upside Volatility

via SMB Capital – Day Trading Blog:

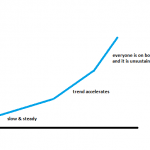

The price action in 2012 presented a very compelling case for a strong market and low volatility in 2013 (see post on #NewNormal). It wasn’t the price action in isolation though. 2012 was in such stark contrast to the latter part of 2011 it really set off alarm bells in my head. We went from a period of massive volatility related to macro events to a period of suppressed volatility despite a constant stream of macro headline risk. So while many experienced traders and newbs alike (in my trading world) were making bets on the impending major market pull back, I continued to “preach” every morning on our desk that we should continue to follow the #NewNormal playbook: focus on buying stocks/sectors Read more [...]

The price action in 2012 presented a very compelling case for a strong market and low volatility in 2013 (see post on #NewNormal). It wasn’t the price action in isolation though. 2012 was in such stark contrast to the latter part of 2011 it really set off alarm bells in my head. We went from a period of massive volatility related to macro events to a period of suppressed volatility despite a constant stream of macro headline risk. So while many experienced traders and newbs alike (in my trading world) were making bets on the impending major market pull back, I continued to “preach” every morning on our desk that we should continue to follow the #NewNormal playbook: focus on buying stocks/sectors Read more [...]

For more info: Some Thoughts on 2014: Upside Volatility

SMB Capital – Day Trading Blog

Some Thoughts on 2014: Upside Volatility

The post Some Thoughts on 2014: Upside Volatility appeared first on FX FOREX.

via WordPress http://www.evvi.net/5536/trading/some-thoughts-on-2014-upside-volatility.html

Trading, alarm, bets, buying, contrast, desk, experienced, isolation, risk, sectors, trading, volatility

Nessun commento:

Posta un commento